Details, Fiction and Social Security login

Wiki Article

The current Social Security method Employed in calculating the gain level (Principal coverage amount of money or PIA) is progressive vis-à-vis decrease ordinary salaries. Anybody who labored in OASDI lined work as well as other retirement could well be entitled to equally the alternative non-OASDI pension and an Previous Age retirement reap the benefits of Social Security. As a consequence of their restricted time Doing the job in OASDI protected work the sum in their protected salaries instances inflation aspect divided by 420 months yields a small adjusted indexed regular monthly wage in excess of 35 many years, AIME. The progressive mother nature on the PIA formulation would in outcome permit these employees to also get a rather greater Social Security Reward share on this small common wage.

They can also release mothers and fathers' names in situations where by the variety holder over the SS-five is not less than 100 yrs of age. This restriction is, regrettably, a tiny bit challenging when your goal of requesting the SS-5 is to understand the names on the mom and dad.

Every time a retirement beneficiary dies, a widow(er) or surviving divorced spouse is normally qualified for your regular benefit quantity equivalent to that gained through the retirement beneficiary.

Quite a few employees and retirement and disability devices opted to keep out from the Social Security program due to the Value along with the constrained Rewards. It absolutely was frequently less expensive to obtain greater retirement and disability Rewards by remaining inside their original retirement and incapacity options.[seventy nine] Now, only a few of such programs enable new hires to join their present plans without having also becoming a member of Social Security. In 2004, the SSA believed that 96% of all U.S. personnel were being included from the program with the remaining four% mainly a minority of government staff members enrolled in public personnel pensions and never subject to Social Security taxes as a result of historical exemptions.[eighty]

At the time we get your application, we’ll review it and call you if We have now any inquiries. We'd ask for additional paperwork from you before we could method your application.

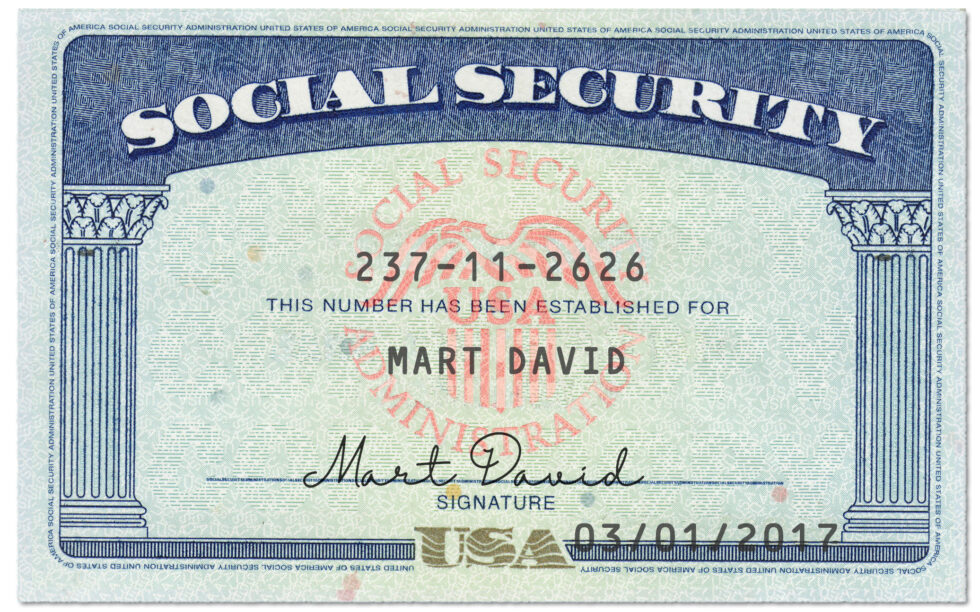

When you don’t will need any variations to your Social Security Selection report (for instance a title or day of start transform), making use of for the substitution card on the internet is your most easy solution. You don’t ought to mail evidence or stop by an Place of work.

90%. There isn't any maximum limit on this part of the tax. This part of the tax is utilized to fund the Medicare software, that is largely answerable for furnishing health and check here fitness Advantages to retirees in addition to shell out Gains to All those on incapacity.

June two, 2021 two:46PM Hi, Jenny. Many thanks for permitting us know. Frequently, we will only Get hold of you When you have requested a simply call or have ongoing organization with us. Recently, ripoffs—misleading victims into making cash or gift card payments in order to avoid arrest for Social Security variety complications—have skyrocketed.

Don’t trust, also verify. If your cellphone’s caller identification claims “Social Security Administration,” don’t believe in it — the variety could possibly be spoofed and also the company only calls beneficiaries in limited predicaments.

Information on nearly all consumers of the telecommunications giant AT&T was downloaded to a third-occasion System in the 2022 security breach.

September fifteen, 2021 4:55PM Hello. I despatched in all of the paperwork for myself and my two young children for substitute Social Security cards I got the passports delivery certificates and my motorists license back but I didn't get Social Security cards there’s no other correspondence really should I be expecting the cards to generally be coming in the subsequent handful of times

[ninety six] University of California Retirement Prepare retirement and incapacity approach benefits are funded by contributions from the two customers along with the College (usually five% of salary each) and by the compounded financial investment earnings on the accumulated totals. These contributions and earnings are held in the have faith in fund which is invested. The retirement Rewards are far more generous than Social Security but are thought to get actuarially seem. The leading difference between point out and native federal government sponsored retirement units and Social Security is that the point out and native retirement techniques use compounded investments that are generally closely weighted in inventory current market securities, which Traditionally have returned a lot more than seven.0%/year on normal Inspite of some many years with losses.[97] Short-term federal government investments may be safer read more but spend Substantially decreased common percentages. Nearly all other federal, condition and native retirement methods do the job in an analogous fashion with unique benefit retirement ratios. Some programs are actually coupled with Social Security and they are "piggy backed" on top of Social Security Gains. For example, The existing Federal Employees Retirement Procedure, which addresses the overwhelming majority of federal civil support staff members hired immediately after 1986, brings together Social Security, a modest defined-advantage pension (one.1% every year of company) plus the outlined-contribution Thrift Price savings Plan.

"Distributional Results of Reducing the price-of-Dwelling Adjustments". Social Security Administration Investigate, Data, and Plan Evaluation. Retrieved January 26, 2020. ^ IRC § 6672 supplies "Anyone needed to acquire, truthfully account for, and spend in excess of any tax imposed by this title who willfully fails to gather this sort of tax, or truthfully account for and pay in excess of this sort of tax, or willfully tries in almost any way to evade or defeat any such tax or even the payment thereof, shall Together with other penalties provided by legislation, be liable to the penalty equivalent to the entire number of the tax evaded, or not gathered, or not accounted for and paid out about." ^

Critics have drawn parallels among Social Security and Ponzi strategies,[177][178] arguing which the sustenance of Social Security is due to ongoing contributions over time. One difference between a traditional Ponzi plan and Social Security, is the fact even though both of those might have similar constructions—in particular, a sustainability dilemma when the volume of new people today having to pay in is declining—they've got differing degrees of transparency. In the case of a conventional Ponzi plan, The actual fact that there's no return-making system apart from contributions from new entrants is obscured[179] Whilst the Social Security plan is intended to have payouts openly underwritten by incoming tax revenue plus the curiosity to the Treasury bonds held by or with the Social Security plan.